The Valuation Cost of Shipping Too Fast in Product Management

Rushing product launches can erode confidence and valuation. Discover how hidden costs of shipping too fast impact investors, markets, and long-term growth.

“Move fast and break things.”

That was Facebook’s famous mantra in its early years.

Reid Hoffman, LinkedIn’s co-founder, went further:

“If you’re not embarrassed by the first version of your product, you launched too late.”

Start-up culture made these lines gospel. From The Lean Startup to Y Combinator demo days, the lesson seemed clear: speed is survival. Ship fast, or risk being irrelevant. And honestly, there’s truth in that. Speed can be a weapon. It helps you learn faster, adapt faster, and sometimes win markets before competitors even realize what’s happening.

I think we often forget that speed might not be free. What if, in the rush to go faster, we’re paying a cost we don’t see on sprint boards — but that quietly eats away at valuation?”

A Payday Loan in Disguise

Think about the last time your team felt pressure to launch quickly.

Maybe a competitor released something shiny and your CEO said, “We need to respond fast.” Maybe a board meeting was around the corner and you needed proof of momentum. Maybe you were just tired of delays and thought, “Let’s get it out and deal with problems later.” So, you launched. You got the short-term win. People clapped in Slack. Maybe even the press picked it up.

But here’s the thing: every rushed launch is like taking a payday loan. You get the cash-like buzz upfront — speed, headlines, momentum. But the interest rate is brutal.

You end up paying it back in hidden fragility: corners cut, risks ignored, resilience weakened. And the real penalty isn’t just operational. It’s in confidence — the quiet fuel behind every valuation multiple. Once that slips, your market story starts to erode.

Not About Bugs — About Signals

Here’s the part I think most teams miss: the market might not care about the bug itself — but about what the bug seems to say about you.

When a rushed launch stumbles, teams obsess over the bug itself. They might reassure themselves:

“It’s minor, we’ll patch it next sprint.”

“Customers will forgive us.”

“This is what iteration looks like.”

But to boards, investors, and competitors, the picture might look very different.

· An investor might not see “iteration.” They might see fragility — and start asking: Can this company really scale without breaking apart?

· A board member might not see “momentum.” They might see risk — and begin wondering if leadership is losing control.

· A competitor might not see “courage.” They might see desperation — the kind of move a company makes when it needs to prove itself, not when it’s playing from strength.

That’s the real danger. It’s not the defect in the product. It’s the story the defect talks about you. And when the signal is fragility, markets quietly discount your value.

How I want to see it

Here’s a lens I think that might help. Imagine every launch carried a hidden score — a number that told you how fragile you looked.

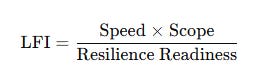

Call it the Launch Fragility Index (LFI):

Speed = how much faster you’re pushing than your normal pace.

Scope = how big and complex the launch is.

Resilience Readiness = how prepared you are with testing, stress checks, and backup plans.

Each part of the formula can be thought of on a 1–5 scale (where 1 = low, 5 = very high).

The math is simple: the higher the score, the shakier you look.

Example 1: Small Feature, Rushed but Ready

Speed: 2× faster than normal (you cut the cycle in half).

Scope: Small (just 1 feature).

Resilience Readiness: High (lots of testing, clear rollback plan).

LFI = (2 × 1) ÷ 4 = 0.5 → Low fragility.

Interpretation: Moving faster, but on a small, low-risk feature with safety nets. I think board will likely see this as momentum, not fragility.

Example 2: Big Launch, Normal Speed, Weak Readiness

Speed: Normal pace (1×).

Scope: Large (full redesign across multiple systems).

Resilience Readiness: Low (testing cut short, no stress checks).

LFI = (1 × 5) ÷ 1 = 5 → High fragility.

Interpretation: Even without rushing, I think the sheer size and lack of preparation scream risk. Board and investors may see a red flag in this.

Example 3: Huge Launch, Rushed, Poor Readiness

Speed: 3× faster (cut a 9-month roadmap into 3 months).

Scope: Massive (new product line).

Resilience Readiness: Weak (few tests, team under stress, no backup plans).

LFI = (3 × 10) ÷ 1 = 30 → Extremely high fragility.

Interpretation: This is the kind of launch that gets headlines — but also creates doubt. Investors might question sustainability. Boards might worry leadership is chasing optics, not building resilience.

And when you look shaky, you pay the Velocity Discount — the hidden tax in confidence, trust, and valuation that comes from moving too fast.

Example 4: Huge Launch, Rushed but Well-Prepared

Speed: 5 (very high — compressing a long roadmap into a short window).

Scope: 5 (massive launch, new product line with multiple moving parts).

Resilience Readiness: 5 (extensive testing, stress simulations, multiple rollback plans, leadership alignment).

LFI = (5 x 5) ÷ 5 = 5 → High fragility?

Interpretation:

This is a case where speed and scope are both maxed out — but so is readiness. On paper, it looks like a “moonshot” launch. To the market, this doesn’t automatically scream fragility. Instead, it might signal capability and confidence.

Investor view: “They’re moving fast, but clearly under control. This company might be ahead of the curve.”

Board view: “They’ve taken a bold bet, but they’ve anticipated failure modes and built safety nets. This feels managed.”

Competitor view: “They didn’t just sprint recklessly. They sprinted like an athlete with discipline. That’s harder to attack.”

This is where I think high resilience flips the story. Instead of looking desperate, the company looks strategic and prepared. The risk is still high — because complexity × speed always carries danger — but the signal isn’t fragility. It’s strength.

Stories You Already Know

You’ve probably seen this play out.

WeWork

WeWork scaled at breakneck speed, but the real fragility came from scope. They signed massive, long-term leases (huge commitments) while renting desks short-term (fragile model). The bigger the scope of their expansion, the shakier it looked. Investors might not have seen resilience here — they might have seen reckless scope without readiness. (Scope too high, Readiness too low → Fragility Index spiked.)

Robinhood

Robinhood sprinted to add millions of new users before its IPO — a classic speed play. But its systems crashed during peak volatility because resilience readiness was weak. To users, it was an outage. To investors, it was fragility: a financial platform unable to handle stress at scale. (Speed too high, Readiness too low → Fragility Index soared.)

Peloton

Peloton raced to capture pandemic demand, expanding scope into new markets while rushing production (speed) and neglecting safeguards (readiness). The result: faulty treadmills, supply chain bottlenecks, recalls, and collapsing trust. What looked like growth might have turned into fragility signals the market couldn’t ignore. (Speed high × Scope high ÷ Readiness low = Maximum fragility.)

Different companies, same pattern:

Speed → Fragility → Confidence lost → Valuation dragged.

Why Leaders Still Rush

If the risks are this obvious, then why do smart leaders keep rushing? I think one big reason is that speed isn’t just about strategy. It’s also about psychology

They might be afraid of looking slow.

Boards might often reward the signal of speed more than the substance of resilience.

And bias — especially loss aversion — might be making them fear losing momentum more than value building durability.

So, teams push for speed not because it’s always the best choice, but because it feels safer in the moment. Ironically, that fear of looking weak often produces the exact weakness we’re trying to avoid.

The Three Fragility Questions

Therefore, I think, before your next launch, I think it’s worth asking these three questions:

Are we shipping because the market truly needs this — or because we’re afraid of looking slow?

What resilience steps have we skipped — testing, backup plans, stress checks — just to hit this date?

If investors read this launch as a signal, would it raise their confidence, or lower it?

If those questions make you pause, it’s worth asking: are we launching a product, or are we launching fragility?

See It Differently

Here’s the alternative view I’d suggest:

Roadmaps aren’t execution lists. They’re valuation stories.

Launches aren’t about being first. They’re about showing resilience.

Speed isn’t neutral. It’s priced. And when it looks fragile, it’s taxed.

Once you see launches this way, it’s hard to unsee. Because you realize: speed doesn’t just break things. It breaks confidence. And in the boardroom, confidence is the one thing that multiplies value. Most teams I think will keep sprinting. They’ll celebrate how fast they shipped, even as fragility quietly erodes trust and valuation.

But we should stop and ask:

What story is our roadmap really telling?

Are we signalling strength, or fragility?

Are we unknowingly paying the Velocity Discount?

© Arcaence™ — All frameworks and visuals are protected intellectual property. Reuse by permission only.